Introduction

In the financial industry, investment banking is regarded as the most complicated area. It entails underwriting, mergers and acquisitions, IPOs, due diligence, and securities trading. Investment banking necessitates precision and accuracy due to its critical role in the world economy.

Investment banking is considered intricate because of the large sums of money involved, the high level of risk, and the need for constant attention to detail. You need a specific skill set to handle these complexities and work in a high-pressure environment.

Although investment banking offers lucrative compensation, it is perceived as a highly demanding job. It requires high qualifications like CFA, which adds to talent acquisition challenges in this field.

When there is already a risk of recession and a hike in interest rates reaching 5.0% worldwide due to rising inflation, finding the best resource to keep your operations alive and maintain your growth is the need of the hour. This blog will discuss investment banking positions, the challenges investment banks face while acquiring talent, and the way forward.

To commence, let’s start with understanding the roles and responsibilities of the team in an investment bank to gain more insights and understand the difficulties involved in filling these positions.

Understanding the Hierarchy in Investment Banking

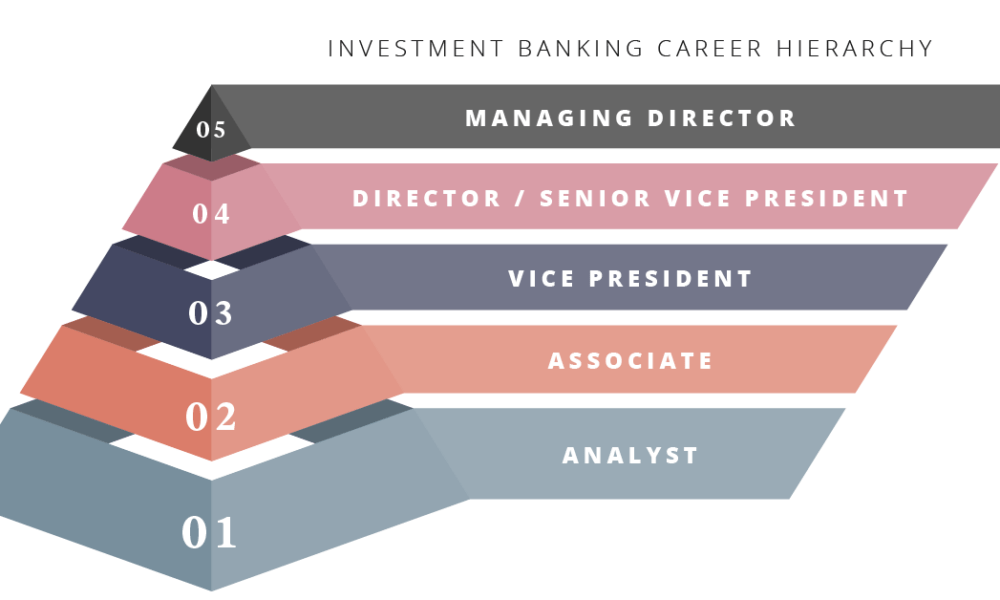

The traditional hierarchical structure of an investment bank includes a team of analysts, associates, a vice president, a senior vice president, and a managing director.

Moving up in this structure, recruitment tends to be more complicated, and hiring for each role requires different expertise, exposure, and experience. Let’s delve deeper to get insights into the responsibilities of each position in the front office and the skills it requires.

Analyst

It is considered an entry-level job in the front office of the investment bank. An analyst must do all the required work, from financial modeling for the client to company analysis, due diligence, making presentations, and maintaining pitch books.

The role of an analyst is very dynamic, and to achieve that, the candidate should also be agile and able to adapt according to the situation. Usually, CFAs with solid research and analytical skills in finance and investment, along with complementary communication and soft skills, are considered the best fit for this role.

Associate

An associate is considered a team leader of analysts and mainly comes from top CFA colleges or is promoted from an analyst. Associates are responsible for supervising the analysts and doing the same stuff, but the responsibilities of each associate change with each passing year.

An associate also interacts with the client and other investment banks, gives presentations, and acts as a bridge between senior management and analysts. This position requires strong communication and negotiation skills and technical knowledge.

Vice President

A vice president of an investment bank is seen as more of a project or relationship manager. This particular position, typically acquired by a third-year associate, is accountable for managing the overall operations of the bank as well as maintaining the relationship with the client and other senior bankers.

For this position, you will need a ton of experience in fundraising, mergers and acquisitions, investment banking transactions, and strong leadership abilities to mentor a team. Candidates for this position must have an MBA or CFA background.

Managing Director

The managing director oversees all operations within the investment firm and is accountable for the bank’s profitability. Building and maintaining relationships with the client and other market sharks will also be part of the job description.

The managing director should have deep industrial knowledge, domain expertise, and the capability of managing the sales call, the team, and the clients.

As we have analyzed the prominent roles in the hierarchical structure of an investment bank, we know how an amalgamation of complex skill sets is required to fill these positions. Now, looking into the challenges and locating the solutions would be easy.

Challenges of Talent Acquisition in Investment Banking

Due to rapid changes in the operation of businesses, investment banking is also going through a process of continuous evolution and is facing untraditional threats and challenges. These challenges range from adapting fintech to cyber threats, talent acquisition, etc.

Among all these challenges, talent acquisition is central due to its significance and role in any bank’s growth. If you funnel down the whole situation, there are some core issues in acquiring talent, particularly in this field, which we will discuss in this section.

Talent Gap in the Investment Banking Job Market

Investment banking is considered a high-paying occupation, but living in a time of self-reflection where everyone is thinking about mental peace and work-life balance has become the new buzzword of the job market.

Gen Z has a lot of options to go for, with equal compensation and less pressure, which creates a need for more talent in this industry. Finding the relevant skill set poses challenges for industry leaders.

Relevant Industrial Knowledge & Domain Expertise

Finding relevant industrial knowledge in investment banking and especially locating a domain expert analyst will be like looking for a needle in a haystack, which will be time-consuming and require proper candidate mapping.

Recruiting such talent is not possible without the assistance of a specialized talent acquisition firm and poses a critical challenge in hiring new talent.

High Pay Scale

The salary for an expert analyst ranges from $100,000 to $230,000 a year, which makes it even more challenging to find the right candidate within the specified budget.

Additionally, the demand for domain expert analysts in investment banking is high, leading to fierce competition among firms to secure the best talent.

Amidst this situation, the recruitment team should acquire strong market knowledge and negotiation skills to recruit the best possible candidate within the allocated budget.

These are some of the core issues an investment bank or wealth management company faces while acquiring talent from the job market.

Solutions

Now that we have evaluated the challenges investment banks encounter when recruiting new candidates, it’s time to examine potential solutions to these problems.

Area of Acquiring Talent

While acquiring talent for a specific position, a competitor analysis is essential to find a fit according to the requirements and locate where you can reach that particular skill set.

This process would include wholesome candidate research from competitive banks, international banks, audacity firms, and wealth management firms.

Specifying the area of talent acquisition plays the most crucial role in finding the best fit and helps ease the whole process. This area specification provides convenience for later steps like candidate mapping and candidate industry benchmarking.

Talent Industrial Benchmarking

After specifying the candidate’s area, you can use industry benchmarking to narrow the talent pool and save time and resources. This step will help you find the most relevant candidate with deep industry knowledge and domain expertise according to your requirements.

Hiring Talent Acquisition Firm

Hiring a talent acquisition firm like RFS HR with expert recruitment and executive search specialists can be the most convenient way out of this situation. These hiring firms have all the expertise to discover, analyze, evaluate, and onboard the best possible candidate according to your needs and requirements.

Using advanced recruitment means, these talent acquisition firms null the chances of error, saving valuable resources and time.

Additionally, providing ongoing training and development opportunities to enhance employees’ skills and knowledge, encouraging diversity and inclusivity in the workplace to attract a wider pool of talent, and fostering a culture of work-life balance to improve employee satisfaction and retention rates are essential and can help you beat the earlier discussed challenges.

Conclusion

Due to a lack of qualified candidates and high salary demands, finding the right people for investment banking is a difficult task. Investment banks can overcome these challenges by determining their recruitment needs.

Following the earlier mentioned solution, evaluating themselves against industry norms and working with expert recruitment agencies like RFS HR can ensure that investment banks acquire the best talent pool, which will ultimately play a pivotal role in growth and development.